Employee retention credit calculation example

You own the entire company. Find out if you qualify for the ERTC Program.

Guest Column Employee Retention Tax Credit Cheat Sheet Repairer Driven Newsrepairer Driven News

Ad 96 of our clients get qualified and approved.

. A refund for employee wages paid in 2020 claim your refund credit of up to 5000 per employee only. The new law adds an enhanced ERC for 2021. Ad Find out if you qualify for the ERTC Tax Credit.

The Employee Retention Credit ERC was enacted as part of the Coronavirus Aid Relief and Economic Security Act CARES. You Took Care of Your People Our Tax Industry Expertise Will Help You Claim The ERC Credit. Tax Incentive For Businesses Who Employ Individuals In Recovery From Substance Use.

For example businesses that file quarterly employment tax returns can file Form 941-X Adjusted Employers Quarterly Federal Tax Return or Claim for Refund PDF to claim the credit for prior. Eligible businesses have the opportunity to claim 50 of their. That is a potential of up to 5000 per.

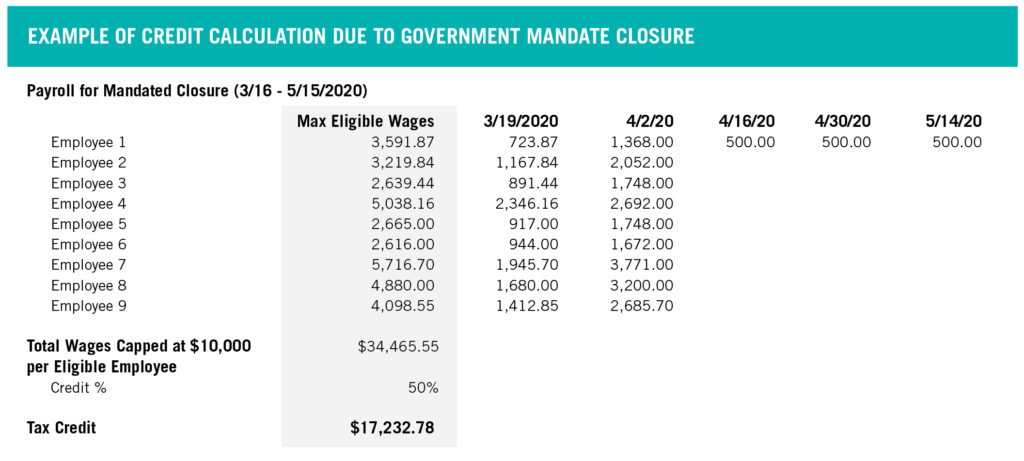

Employee Retention Credit Example In the year 2021 lets say you run your dental office as an S company. Ad Get the ultimate guide on how to lower turnover and boost retention. For 2020 the Employee Retention Credit is equal to 50 of qualified employee wages paid in a calendar quarter.

Up to 26000 per employee. Calculating these wages is simple yet it can be pretty complex if this is your first time claiming the credit. The calculation example above demonstrates how to calculate this amount.

100 Money Back Guarantee. The 2020 ERC Program is a refundable tax credit of 50 of up to 10000 in wages paid per employee from 31220-123120 by an eligible employer. Up to 26000 per employee.

Put Cash Back Into Your Business. No limit on funding. Check to see if you qualify.

Get Up To 26k Per Employee Even If You Received PPP Money. How to Calculate Employee Retention Credit A simple example can be one of the easiest approaches to illustrate this credit estimation. Our Tax Experts Can Help.

Employee Retention Credit Examples 1 Companies with 5 100 employees A few common examples of small employer companies with 5-100 employees include law offices. This means that you can claim up to 28000 worth of credits per employee for the year. Up To 33K Credit Per Employee.

Your three workers are not. Many ways to qualify. Our clients get up to 30 more.

The small company Employee Retention Credit allows companies to deduct 70 of an employees qualified pay up to 10000 every quarter on the qualified wages. You can earn a tax credit of up to 33000 per employee in wages paid under the Employee Retention Credit ERC if your business was financially impacted by COVID-19. Additionally the credit limit was increased from 5000 for the year to 7000 per quarter.

And thanks to the latest new law the American Rescue Plan Act of 2021 ARPA the. This credit helps offset the costs of maintaining staff during the employment pandemic. Ad We take the confusion out of ERC funding and specialize in working with small businesses.

EY Employee Retention Credit Calculator. For employers with less than 100 full-time employees qualified wages are all of the wages paid to employees. The credit applies to wages paid after March 12 2020.

Ad Borrowers Of Paycheck Protection Program Can Now Qualify For The Employee Retention Credit. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. The credit was increased from 50 of qualified wages to 70 of qualified wages.

No limit on funding. As workers are resigning here are better ways to recruit and retain top talent. You pay 30 percent.

Qualified salaries and expenditures for 2020 are capped at 10000 per employee for the year with a credit of up to 50 of that amount allowing you to claim up to 5000 in. One employee Say you have one employee and you pay them 10000 in qualified wages in Quarter 1 of. However you should still consult with.

Check to see if you qualify. You obtain the tax credit which is a dollar-for-dollar reduction in your payroll and then lose the tax deduction for the tax credit money you put in your pockets. Ad We take the confusion out of ERC funding and specialize in working with small businesses.

The ERC calculation is based on total qualified wages including health plan expenses paid by the employer to the employee. Turn again to the trusty ERC calculator to work out how much you should be claiming in. But it ends retroactively in 2022 and is only available to employers with full-time.

Lets take a look at a few Employee Retention Credit examples. You obtain the tax credit which is a dollar-for-dollar reduction in your payroll and then lose the tax deduction for the tax credit money you put in your pockets. Ad Talk To Our Employee Retention Credit Experts To Determine If You Are Eligible For Credit.

Our CPAs Tax Attorneys work every angle. The ERC equals 50 percent of the. Ad Get up to 26K per employee from the IRS With the ERC Tax Credit.

The benefits of calculating your employee retention credit include.

Employee Retention Credit Erc Calculator Gusto

2

Employee Retention Tax Credit 941x Instructions Ertc Youtube

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

Calculating Your Employee Retention Credit In 2022

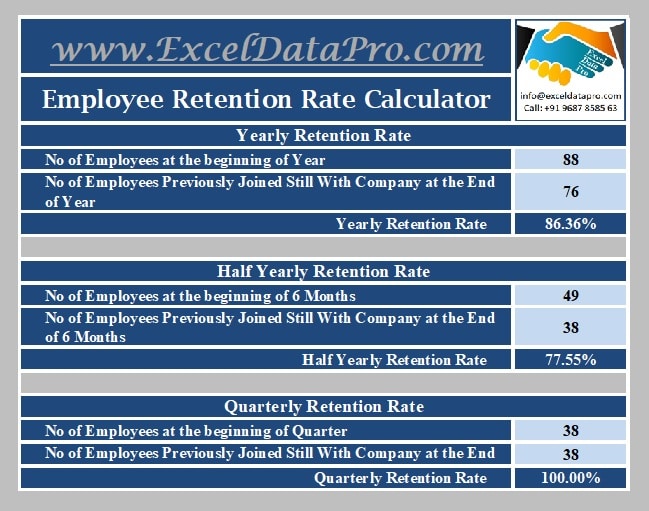

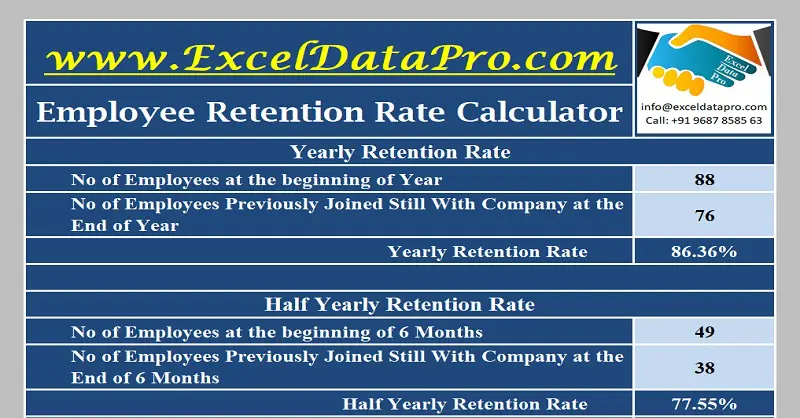

Download Employee Retention Rate Calculator Excel Template Exceldatapro

Changes To The Employee Retention Credit Erc

Employee Retention Credit Erc Calculator Gusto

2

Download Employee Retention Rate Calculator Excel Template Exceldatapro

Irs Guidance On Employee Retention Credit Doeren Mayhew

A Guide To The Employee Retention Tax Credit Cerini Associates Llp

Employee Retention Credit Spreadsheet Youtube

Covid 19 Relief Legislation Expands Employee Retention Credit Insights Ksm Katz Sapper Miller

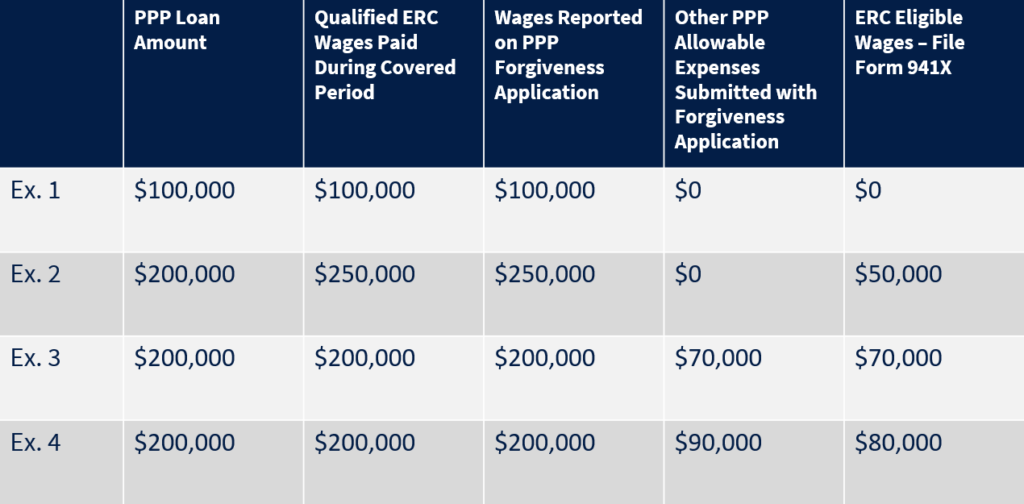

Employee Retention Credit Irs Updates Guidance On Ppp Coordination Issues And More Sc H Group

2